Salesforce.com is all set to buy Buddy Media for a rumored $800 Million. Salesforce supposedly beat Google in the bidding. This deal follows Oracle’s recent purchase of Vitrue for $300 Million dollars. These two deals are great for all the companies operating in this space (Involver, Wildfire, AppAddictive) Companies that offer a suite of applications for Facebook publishing, Facebook page management, and Facebook ad campaign management stand to benefit the most. Among the independent enterprise Facebook platforms, only AppAddictive has all the components – Pages, Publishing and Facebook Ads API access.

Buddy Media and Vitrue are the platforms agencies and brands use to publish, design pages, and buy ads on Facebook.

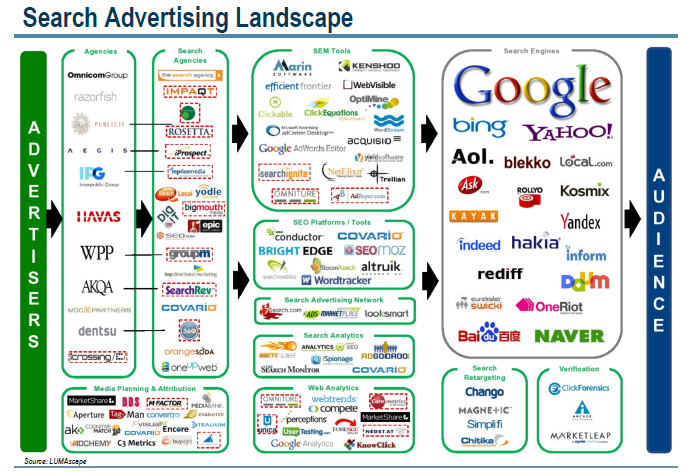

When Google IPO’ed in 2004, it created the entire Search Engine Optimization and Search Engine Marketing industry where thousands of multi-million dollar companies exist around Google. (See image below)

Likewise Facebook’s recent IPO means Facebook will create the Social Media Marketing and Social Advertising industry where thousands of multi-million dollar companies will exist around Facebook in the future. (See image below)

When Google went public, its market cap was at $23 Billion. Google’s market cap is now $193 Billion. Google supports an ecosystem of several companies.

The theory of the Wisdom of Crowds and George Soros’ Theory of Reflexivity state that for most of the time, the market is relatively quite good about predicting the future valuation of a company. On the other hand, the theory of value investing is that at times, the markets can be terribly wrong about valuations. For instance, in the Internet boom, the markets were clearly wrong about the valuations of several dotcom companies that ultimately went bust.

But unlike the other dotcoms that held negative losses, both Google and Facebook are hugely profitable. In the case of Google, the “Wisdom of Crowds” seem to have held true. Google went on to become much bigger than its IPO price. What will be the case with Facebook?

Recent Comments